Are you ready to preserve Charleston’s charm?

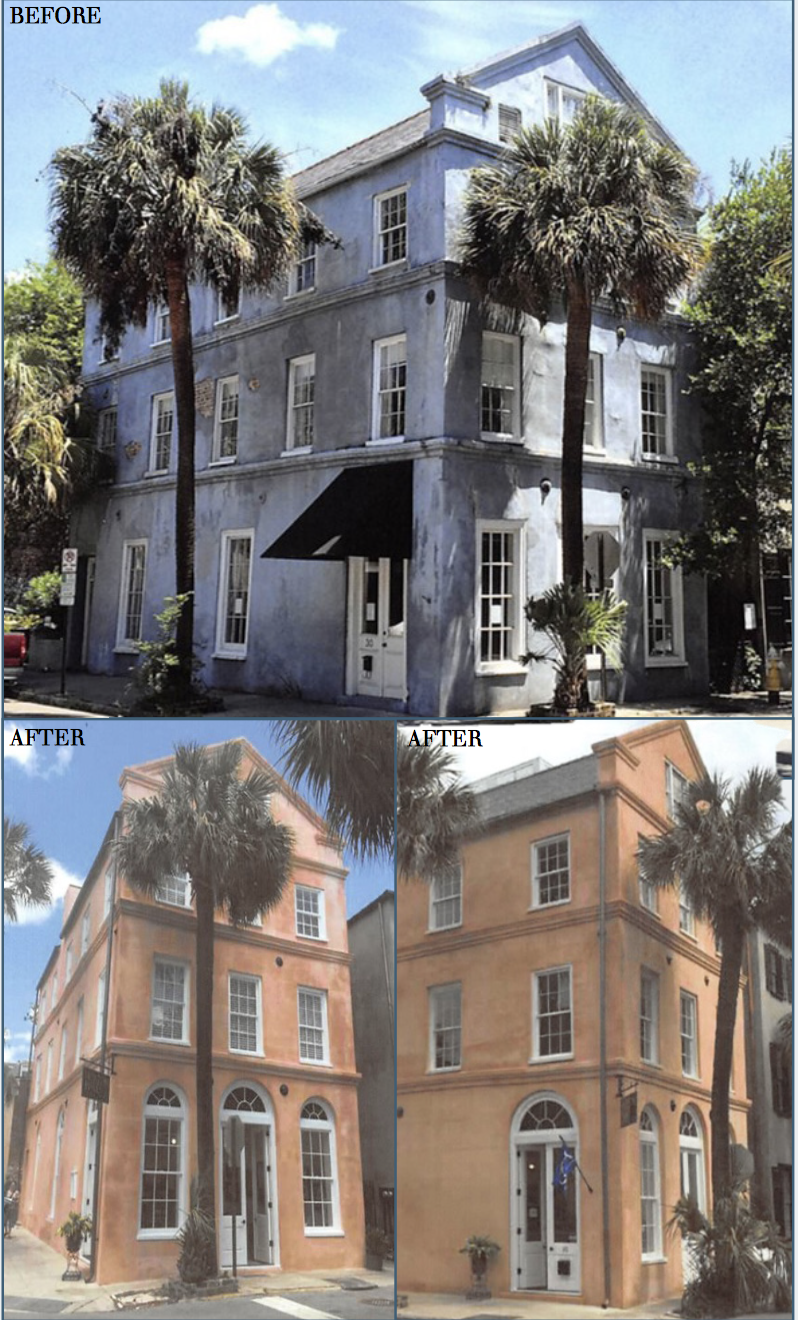

Consider purchasing a property on the National Register of Historic Places, fixing it to match your vision and keep the charm of Charleston.

Income-producing tax credits are available for properties listed in the National Register of Historic Places or located within a National Register listed historic district and certified by the National Park Service, and listing as contributing to the district’s character and retaining its historic appearance. After rehabbing the property, you must own the building or use it to produce income for 5 years.

What we really mean by this: If you are interested in a space that needs a facelift, and gives you options to rejuvenate a space in the community, consider a property on the SC Historic Properties Record and or SC ArchSite(GIS). A few key steps include:

-a property you want to bring back to life

-a vision to use the property for a business (check out the FAQs for mixed-use properties)

-photographs

-rehabilitation costs must be greater than $5,000 within a 24-month period

When you’re ready to bring your business dream to reality, give us a call or send an email.

For more on FAQs about income-producing tax credits, head over to the South Carolina Department of Archives History, contact a tax attorney or specialist, and review the application process.

One thing I’ve noticed is the fact there are plenty of fallacies regarding the banks intentions while talking about foreclosures. One fantasy in particular is the fact the bank desires your house. The financial institution wants your hard earned dollars, not the house. They want the amount of money they lent you with interest. Keeping away from the bank will undoubtedly draw a foreclosed summary. Thanks for your publication.

Wow that was odd. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say excellent blog!

It抯 onerous to find educated people on this matter, but you sound like you know what you抮e speaking about! Thanks