The greater Charleston area has a broad spectrum of commercial property types, including industrial, office, retail, restaurant/entertainment, and of course, hospitality and tourism oriented. In this month’s blog, we highlight areas of commercial growth, the most lucrative commercial typologies, and JJ Rahnamoon of Charleston Empire Properties gives advice on the hottest commercial trends to follow this year.

A Hot Market

Avison Young reports that in 2024, “Charleston’s asking rental rates continue to rise, with office availability nearing pre-pandemic levels. The market is seeing an uptick in subleasing activity, but overall leasing volume is down slightly from last quarter. Tenant demand remains strong for properties in Downtown Charleston, as the submarket boasts the lowest availability.” Vacancy rates are dropping, and rental rates are increasing as an average of 43 people move to the tri county area each day. According to Real Estate Information Services, the area has the 10th lowest vacancy rate in the United States and the 2nd lowest in the southeastern region. Greenville Business Magazine notes that “real estate brokers see a market poised for strong growth for years to come.”

STRs and AirBnbs

Short Term Rentals continue to rise in popularity not just in downtown Charleston’s historic areas, but in the island communities near the beaches, and in further afield suburban communities as tech and other workers are relocating to the region in droves. These new residents will usually make a purchase, but often must relocate quickly and need a short-term lease close to their new jobs. Retirees who are considering a permanent move also like STRs so they can acclimate themselves with different communities before picking the best fit for their purchase. For all these reasons, STR zoned properties are a sound commercial purchase.

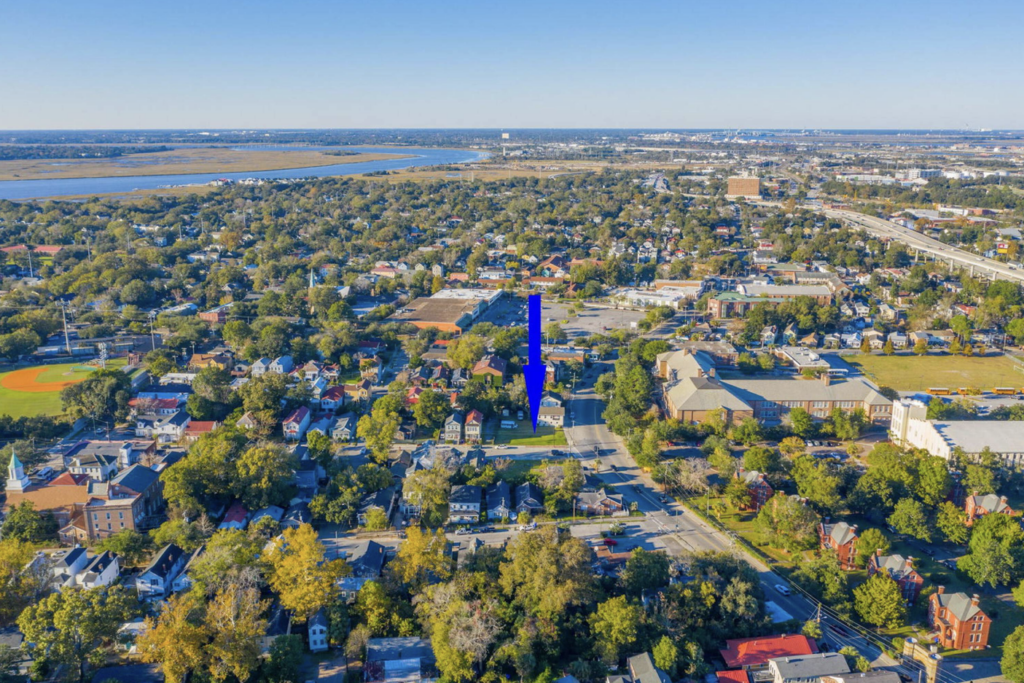

Buyers looking for short term rentals in downtown Charleston (or other parts of the city limits) should be aware of zoning restrictions, which can vary by neighborhood. Cannonborough-Elliottborough on the west side, Eastside/Hampstead near Columbus Street, and Wagener Terrace and North Central are popular areas where STRs may be legal. “Make sure you have 10% NOI [Net Operating Income] if you primary intent to buy an Airbnb eligible property is for investment”, JJ advises.

Office Space

Purchase price and rental rates vary greatly for office spaces (and for retail) in our region. Factors that impact this include parking availability or foot traffic, accessibility from major transportation arteries, branding/image of the area (tech companies tend to prefer trendy up and coming areas), and the number of units. Large office buildings are being constructed on the upper peninsula along Meeting Street and North Morrison as well as in Mount Pleasant, North Charleston, and Summerville.

Office lease rates have risen steadily across 2023 and the beginning of 2024 as the last impacts of the pandemic fade and more people return to a traditional office setting for at least a few days a week. In a post-pandemic, work remote world, however, companies are being more selective about where they locate in an effort to attract workers, which is great news for highly desirable Charleston.

The office market has changed a lot in the last five years, and buyers should consider the challenges. JJ explains that, “once Covid hit that people realized that there is not a huge need for office space if people can work from home. I would also say the lack of parking and bad infrastructure that the city has outlined for the community is not helpful either.”

In historic areas like West Ashley and on the peninsula, adaptive use office spaces and incubator spaces in corner stores or old industrial buildings are becoming popular as a fun and architecturally unique alternative to large office block buildings. 696 Rutledge Avenue, a former corner pharmacy turned office spaces, is a great example.

JJ considers Savannah Highway “the best bang for your buck considering the amount of vehicles that drive by for the purchase price of most of those things. I also factor in the amount of development that the city is planning on Avondale and Dupont Road.”

Industrial Growth and Development

North Charleston’s industrial heritage spans back more than a century and is seeing a resurgence thanks to new maritime development like the Sate Ports Authority’s Hugh T. Leatherman Port Terminal and its new access highway that opened in 2023. Large companies like Boeing, Volvo, Bosch and Daimler Mercedes in North Charleston/Summerville are bringing new residents and encouraging affiliated new businesses and industrial spaces. Warehousing and distribution square footage is leasing and selling as fast as it is built. E-commerce and tech development are also increasing. The region’s industrial vacancy remains lower than %5, a rate considered low by national standards.

Vacant industrial buildings north of Mount Pleasant Street up the peninsula into the North Area can be refurbished and leased to small industrial companies, port and auto satellite industry manufacturers, and other fabricators. There are undeveloped tracts in outer North Charleston into Summerville that are prime for industrial uses. Greenville Business Magazine notes, “Because Charleston is a peninsula with water on three sides and other development constraints, such as a national forest to the north, much of the market’s development is pushing up the Interstate 26 corridor, where land is available, toward I-95 and Columbia. One broker jokingly said that Charleston starts in Orangeburg now.”

Thanks to all the area growth, JJ advises that some of the best commercial properties “are warehouse and storage space. I also think that retail space is good, you just need to be selective about who the tenants are.”

Restaurants and Retail

Like office space, restaurant and retail establishment possibilities depend on an auto versus pedestrian model. Price per square foot downtown is high because shop frontage is at a premium, but tourism, local, and college student foot traffic makes up for the cost. Coleman Boulevard and main arteries on James Island and West Ashley have a mix of planned urban development (people oriented) and auto driven commercial models. Outdoor dining space, rooftop bars, and patios remain the desirable for new restaurant and bar concepts, since the Lowcountry’s weather is tolerable year-round. Retail vacancy rates are “well below 10%”, also a healthy statistic, according to the Post and Courier’s business journalists. JJ advises that commercial clients should proceed with caution when entering the restaurant market, as it tends to be volatile with rapid ups and downs.

Hotels

Downtown Charleston continues to attract hotel development, which includes large new build traditional models like the proposed Four Seasons on Meeting Street near the Market, boutique smaller hotels that cater to young professionals and affluent retirees, and historic adaptive use models. There seems to be no downturn in site. Hotel commercial growth is also occurring as far out as Ridgeville and Nexton (Dorchester County) to service business visitors coming for our international companies, and in Charleston commuter suburbs for the affordability factor. Even the Schitt’s Creek model is being tried, with great success, locally. Built in 1961, North Charleston’s Starlight Motor Inn, with its Burgundy Room lounge, midcentury details, and inground pool, has become one of the most popular places to visit off the peninsula. There’s more commercial opportunities like this to be found or modeled for a new build throughout the suburbs.

Final Thoughts

On whether to lease or buy, JJ says, “I would always suggest buying if you are able to because your chances of making money on real estate is 100% but if you are leveraged when you start the business and have to lease that’s understandable but I would at least get a first right of refusal from the landlord when you sign your lease.” Commercial real estate in the Lowcountry is growing in the areas of short-term rentals, storage, industrial, and retail, and the main factors to consider are whether your potential tenants’ business models are auto or pedestrian driven, along with the least volatile uses. In a place attracting new residents every day, commercial real estate is likely a sound bet, regardless of the area you choose.

Sources:

- City of Charleston STR ordinance. https://www.charleston-sc.gov/1840/Short-Term-Rental-Permit-Information

- Interview with JJ Rahnamoon of Charleston Empire Properties

- Avison Young 2nd Quarter 2024 Commercial report.

- Urbancore Advisors 2024 report.

- Greenville Business Magazine. “Charleston’s bustling commercial real estate market being driven by post-pandemic habits.” April 2022.